Resources

As Cyber Risk increasingly becomes the most common threat, cyber risk insurance helps defray the costs of a breach and offers vital remediation and mitigation support during the recovery phase. Risk Cooperative understands that each organization has its own unique cyber risk profile, and an out of the box solution may not work. Our cyber specialist team has worked to develop a suite of cyber insurance and risk transfer solutions that can be customized to meet specific client needs.

Cyber risk continues to grow everyday. As organizations explore how to best combat this risk, cyber insurance is another resource that can help build resilience. There are many cyber insurance products on the market today, yet not all provide equal levels of protection.

Not all cyber insurance products are created equal. Coverage differences and exclusionary language amongst cyber policies has led to claims being denied, which often results in court rooms determining outcomes or large, unexpected losses that drive companies out of business.

In the evolving cyber insurance market, carriers assess client risk when they review applications for cyber coverage. This checklist summarizes six areas for cybersecurity and the minimum standards that underwriters expect. While criteria for optimum rates and coverage is continually being updated, meeting these standards is a first step toward insurability.

In the increasingly challenging cyber insurance market, clients must be prepared to provide detailed descriptions of their cybersecurity programs. The below sections provide key underwriting questions and considerations required to obtain a cyber quote.

The lines between risk and reward have blurred, as have the lines between private wealth and enterprise/portfolio value. Risk Cooperative and RCM&D have partnered to offer a reimagined private client experience that brings a comprehensive advisory, risk management and risk transfer capability to high net worth individuals.

As a fully licensed independent brokerage, Risk Cooperative can originate, quote and place a large array of specialty lines insurance solutions. Customers need solutions that follow their operations worldwide and Risk Cooperative can help.

Risk Cooperative’s Physical Security insurance solutions are designed to help organizations and academic institutions cope with the growing risk of active shooter and mass casualty events. This specialized program provides a preliminary risk assessment gauging vulnerabilities, as well as on the ground crisis management support, counseling services for victims, and Lloyd’s-backed liability protection to help protect assets from legal costs and reputational harm.

Risk Cooperative is a fully-licensed independent brokerage, operating along the full spectrum of risks and insurance classes, covering life, health, property, casualty and specialty risks. Working with all major global insurance markets and uniquely positioned to help clients address any risk issue.

Risk benchmarking gap analysis provides organizations with a strategic review of their existing risk management frameworks and risk mitigation strategies, as well as an in-depth analysis of potential risk exposure that may have otherwise gone undetected.

Accurately measuring enterprise value (EV) has never been more important or challenging. Even more so because firms are confronted by growing volumes of data, and the stakes implied in misinterpreting the value of that data have risen to new heights.

Moving risk form a cost of doing business to a catalyst for growth, Risk Cooperative offers 3 engagement models based on organizational size and complexity. All engagement approaches are designed to address insurable risks, including employee benefits, property and casualty as well as specialty programs globally.

Cyber Risk

As Cyber Risk increasingly becomes the most common threat, cyber risk insurance helps defray the costs of a breach and offers vital remediation and mitigation support during the recovery phase. Risk Cooperative understands that each organization has its own unique cyber risk profile, and an out of the box solution may not work. Our cyber specialist team has worked to develop a suite of cyber insurance and risk transfer solutions that can be customized to meet specific client needs.

Cyber 101: Coverage Overview

Cyber risk continues to grow everyday. As organizations explore how to best combat this risk, cyber insurance is another resource that can help build resilience. There are many cyber insurance products on the market today, yet not all provide equal levels of protection.

Cyber Exclusions

Not all cyber insurance products are created equal. Coverage differences and exclusionary language amongst cyber policies has led to claims being denied, which often results in court rooms determining outcomes or large, unexpected losses that drive companies out of business.

Cyber 101: Minimum Cybersecurity Checklist

In the evolving cyber insurance market, carriers assess client risk when they review applications for cyber coverage. This checklist summarizes six areas for cybersecurity and the minimum standards that underwriters expect. While criteria for optimum rates and coverage is continually being updated, meeting these standards is a first step toward insurability.

Cyber 101: Sample Technical Specifications

In the increasingly challenging cyber insurance market, clients must be prepared to provide detailed descriptions of their cybersecurity programs. The below sections provide key underwriting questions and considerations required to obtain a cyber quote.

Private Client

The lines between risk and reward have blurred, as have the lines between private wealth and enterprise/portfolio value. Risk Cooperative and RCM&D have partnered to offer a reimagined private client experience that brings a comprehensive advisory, risk management and risk transfer capability to high net worth individuals.

Specialty Risk

As a fully licensed independent brokerage, Risk Cooperative can originate, quote and place a large array of specialty lines insurance solutions. Customers need solutions that follow their operations worldwide and Risk Cooperative can help.

Physical Security

Risk Cooperative’s Physical Security insurance solutions are designed to help organizations and academic institutions cope with the growing risk of active shooter and mass casualty events. This specialized program provides a preliminary risk assessment gauging vulnerabilities, as well as on the ground crisis management support, counseling services for victims, and Lloyd’s-backed liability protection to help protect assets from legal costs and reputational harm.

Insurance Brokerage

Risk Cooperative is a fully-licensed independent brokerage, operating along the full spectrum of risks and insurance classes, covering life, health, property, casualty and specialty risks. Working with all major global insurance markets and uniquely positioned to help clients address any risk issue.

Risk Benchmarking

Risk benchmarking gap analysis provides organizations with a strategic review of their existing risk management frameworks and risk mitigation strategies, as well as an in-depth analysis of potential risk exposure that may have otherwise gone undetected.

Enterprise Value of Data (EvD)

Accurately measuring enterprise value (EV) has never been more important or challenging. Even more so because firms are confronted by growing volumes of data, and the stakes implied in misinterpreting the value of that data have risen to new heights.

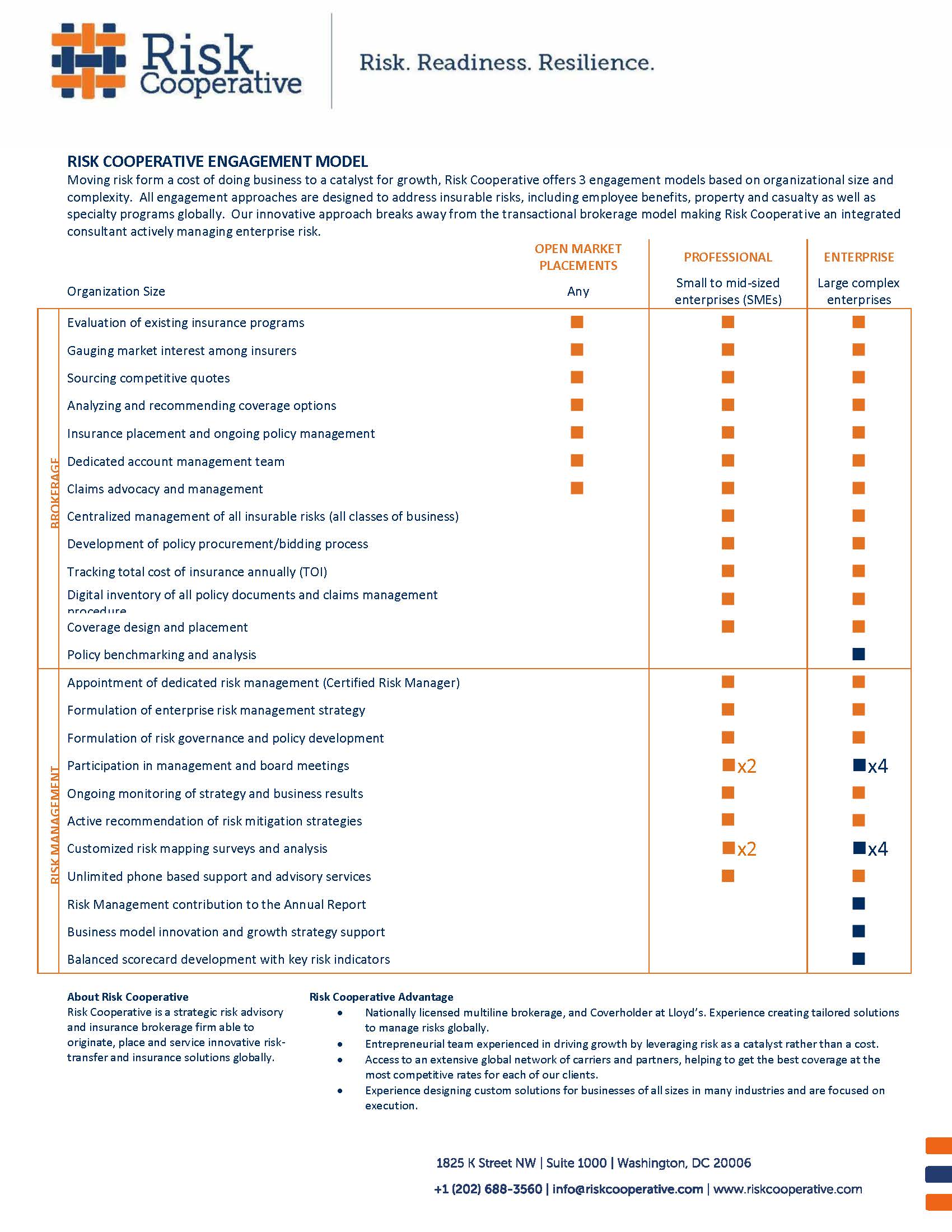

Tiered Engagement Model

Moving risk form a cost of doing business to a catalyst for growth, Risk Cooperative offers 3 engagement models based on organizational size and complexity. All engagement approaches are designed to address insurable risks, including employee benefits, property and casualty as well as specialty programs globally.