Advisory Services

Reputational Risk and Crisis Management

The shifting business environment is testing organizations across a whole set of new and emerging risks categories. This new risk landscape, coupled with greater uncertainty in the world, requires organizations to be prepared to deal with a wide range of crisis scenarios, and more intangible risk categories such as reputational harm.

A company’s reputation is both one of its most valuable assets and one of the more challenging risk exposures to quantify. Organizations need to have a strategic action plan for how to protect their reputations and implement agile, pro-active crisis management.

Risk Cooperative has developed a suite of solutions helping organizations more accurately quantify their reputational risk, build a proactive crisis management and evaluation framework, as well as implement mitigation techniques. These services are aimed at helping organizations manage both their internal and external stakeholders as well as to strengthen their overall reputational resiliency.

Risk Cooperative and its strategic partners provide reputational risk and crisis management services to assist clients through every step of a potential crisis scenario. We work alongside our clients to develop, implement and sustain bespoke programs to meet each client’s varying and unique needs.

Our approach looks at a variety of key factors when helping organizations evaluate their reputational risk and mitigation strategies.

Key Factors

Enterprise Value at Risk

All too often, risk management approaches falter on their inability to offer precise measures of financial, economic or operational business impacts. Our model works to remove the ambiguity from intangible risks and emerging threats like reputational and other forms of risk to quantify the impact on reputation based on identified risks.

Benchmarking / Audits

As a first step to an engagement, benchmarking existing risk management frameworks helps establish a baseline for measurement, and ongoing improvement. This ties in directly to an organization’s risk appetite, tolerance and mitigation strategies.

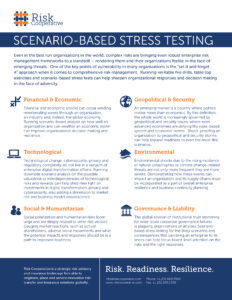

Stress Testing

Running financial simulations for the potential economic consequences of supply chain disruptions will help organizations understanding the economic value at risk given various scenarios. This will also help establish the business case and expected return or resilience gained from supply chain risk management investments.

Risk Reduction Strategies

Enterprise Value at risk engagements include risk reduction strategies for retaining or transferring risk or or partially fund quantifiable risk exposures through hybrid structures.

Crisis Response Plan Design and Implementation

A critical aspect of crisis management is ensuring that an organization is prepared. We work with clients to develop customized crisis response plans that can be implemented across the enterprise. This enables management to respond to any crisis scenario, as well as prevent or mitigate a crisis event.

Crisis Response Training and Development

We provide company-wide training modules designed to test and reinforce crisis preparedness. From tabletop exercises to online training programs, our team is able to design and implement a robust training program that builds operational resiliency and readiness.

Resource Library

This is the third and final installment of our business resiliency best practices, outlining preparedness elements to have in place before a crisis. Part one offers guidance on responding to an active crisis. Part two addresses components of a post-crisis recovery. As you implemented your crisis response and recovery strategies, you no doubt realized that […]

This is the third and final installment of our business resiliency best practices, outlining preparedness elements to have in place before a crisis. Part one offers guidance on responding to an active crisis. Part two addresses components of a post-crisis recovery.

As you implemented your crisis response and recovery strategies, you no doubt realized that the most effective way to respond to a business interruption incident, be it cyber attack, global pandemic, natural disaster, etc., is through careful preparation.

Whether your crisis plan was not sufficiently detailed, had out-of-date information, or for some other reason was less than ideal, the best time to prepare for a crisis is when there’s smooth sailing. These six items will help you lay the groundwork for business resiliency.

CRISIS PREPAREDNESS CHECKLIST

Response Team | When an incident occurs, your partners, clients and employees will need timely information. Empower individuals to take on specific response roles, including communication and incident monitoring. Designate a project leader to lead the response team and designate an alternate in case the project leader is unavailable to lead the team. In many organizations, the risk manager will serve as the project leader. Create an Office Playbook detailing the responsibilities of individuals on the team.

Secure Important Information | Every business has critical documents such as business account information and sensitive data. Develop a plan with IT to have this critical information secured and backed up offsite.

Review Before You Renew | Work with your broker to conduct regular insurance policy reviews to avoid coverage gaps that can be created as your business grows and changes. Explore the coverages found in pandemic policies with your broker as well.

Know Your Supply Chain | Your suppliers and service providers must comply with certain regulations and standards to avoid putting you at unnecessary risk. Moreover, you need to have an understanding of who their suppliers and service providers are and how they are verifying safe practices. Ensure you have the contact information of backup suppliers should you need their services.

Staff Training | It’s important to ensure your staff is properly trained in routine cyber hygiene principles, such as how to identify suspicious sites and emails. Coordinate efforts with IT to conduct frequent training with staff and develop a Cyber Hygiene Playbook.

Establish a Line of Credit | The ability to quickly access a line of credit is critical in preparing for an incident. Ensure you have communicated with your financial institution and established a line of credit to gain access to cash as needed.

A thorough and effective crisis management strategy could be the key to surviving a business interruption event. While this checklist is designed to help to help businesses build resiliency and provide guidance through perilous times, sometimes companies need assistance in establishing their strategy. When in doubt, consult with experienced risk managers who can take your organization step-by-step through the process.

Consult our guidelines for crisis response to help your organization manage an active crisis.

YOU MIGHT ALSO BE INTERESTED IN:

Insurance Solutions , Executive Policies Enterprise Risk Management

This is the second of three installments of our business resiliency best practices, addressing components of a post-crisis recovery. Part three will outline preparedness elements to have in place before a crisis. Part one offers guidance on responding to an active crisis. Now that you have navigated your business through the crisis response checklist and […]

This is the second of three installments of our business resiliency best practices, addressing components of a post-crisis recovery. Part three will outline preparedness elements to have in place before a crisis. Part one offers guidance on responding to an active crisis.

Now that you have navigated your business through the crisis response checklist and the most acute challenges have begun to abate, it is time to implement a thoughtful “back to business” strategic plan.

Any crisis that threatens business continuity – cyber attack, global pandemic, natural disaster, etc. – will have a profound impact on business operations going forward. A strategic crisis recovery plan will position your organization to smoothly restore normal business operations.

CRISIS RECOVERY CHECKLIST

Lessons Learned | Codify your crisis management lessons learned into the Office Playbook, which establishes a Crisis Response Team team and outlines their responsibilities. This will bolster preparation for the next event.

Close the Loop | Provide a final report for your stakeholders outlining the incident resolution and preparedness goals moving forward. Transparency regarding the challenges and solutions builds trust.

Boost Employee Morale | As you transition to normal business operations, re-engage with your employees. Inexpensive and thoughtful incentives such as small gift cards, hand written notes, and other tokens of appreciation can be effective. Also, not everyone will recover at the same rate, so prepare to extend workplace benefits for a period of time after the event.

Address Insurance and/or Security Shortfalls | If you did not have adequate coverage for the incident (e.g. event cancellation, pandemic, or cyber insurance) take the time to procure coverage now. It is always less costly to be prepared.

Consider New Operating Procedures | Did your customers appreciate the additional communications? Did your staff thrive with more flexibility? Consider things that should become part of a new normal.

Prior to transitioning to normal business operations, your Crisis Response Team should convene to discuss your company’s crisis response, focusing on what can be done better to mitigate the effects of future business interruptions. Their experiences and insights are valuable to your organization’s resiliency.

Consult our guidelines for preparedness to ensure your organization is ready for the next business continuity crisis.

YOU MIGHT ALSO BE INTERESTED IN: Insurance Solutions Executive Policies Comprehensive Benefits

This is the first of three installments of our business resiliency best practices, covering responses to an active crisis. Part two will address components of a post-crisis recovery. Part three will outline preparedness elements to have in place before a crisis.

The COVID-19 pandemic exposed the vulnerabilities of organizations to withstand a major business interruption. While a global pandemic is certainly a unique circumstance – never before have so many businesses and individuals globally faced the same existential crisis – the likelihood of another interruption is a matter of when, and not if it will occur.

When a crisis transpires, an organization’s response must address the crisis while preventing negative reputational impacts, protecting current and future business deals, and sustaining employee morale. Guide your business toward resiliency by implementing the items outlined.

CRISIS RESPONSE CHECKLIST

Implement Your Playbook | Review your Office Playbook, which establishes a Crisis Response Team team and outlines their responsibilities. Adjust your action plan as needed for your particular business interruption, then put your team to work.

Overcommunicate | Manage expectations with frequent updates to your employees, partners and clients. Be prepared for this communication to take various forms, including phone calls, text messages, emails, and videoconferencing.

Personnel Check-ins | Check in with your employees and discuss their condition – mentally, physically, and professionally. You may need to change the way you typically implement standard workplace policies to address individual needs. Encourage employees to utilize Employee Assistance Programs (EAPS) or other forms of mental health counseling offered by your health plan.

Confirm Coverage and Compliance | Stay apprised of new and existing state and federal regulations and contact service providers to ensure compliance. Simultaneously, communicate with your broker to assess proper insurance coverage.

Address Cyber Threats | Hackers and malicious actors increase their efforts during a crisis, so remind employees at all levels of operation to consult the Cyber Hygiene Playbook.

Assess Financial Health | Communicate frequently with the finance department to ensure the business has adequate cash flow throughout the crisis response. Alternative financing arrangements may be needed depending on the length of the crises, such as tapping a line of credit, reducing executive compensation, or cutting certain expenses.

These six best practices are applicable toward any crisis that threatens business continuity – cyber attack, global pandemic, natural disaster, and others. By implementing these components, your organization will manage the ongoing challenges with agility, until they begin to abate.

Consult our guidelines for recovery to help your organization navigate the process of getting back to business as usual.

On October 4th, the American Security Project hosted an event on Build Back Better – Responding to Puerto Rico’s Crisis after Hurricane Maria. The panel included Dante Disparte, Chairman of American Security Project’s Business Council for American Security, and the founder and CEO of Risk Cooperative; Brigadier General Stephen A. Cheney, USMC (Ret.), Chief Executive […]

On October 4th, the American Security Project hosted an event on Build Back Better – Responding to Puerto Rico’s Crisis after Hurricane Maria. The panel included Dante Disparte, Chairman of American Security Project’s Business Council for American Security, and the founder and CEO of Risk Cooperative; Brigadier General Stephen A. Cheney, USMC (Ret.), Chief Executive Officer of American Security Project; and Andrew Holland American Security Project’s Director of Studies and Senior Fellow for Energy and Climate.

The panel discussed different strategies for addressing the unprecedented crisis taking place in Puerto Rico due to Hurricane Maria. The discussions centered on the long-term causes for the disaster in Puerto Rico, best policies going forward, financing issues that need to be overcome, and investment opportunities for the island. All of the participants agreed that in the wake of such a disaster, now was the time to address the many intractable problems facing Puerto Rico and to rebuild and revitalize the island better than before.

As a native Puerto Rico and with many family members still on the island, Mr. Disparte had a very personal connection to the tragedy taking place. He explained how when he was a boy growing up in Puerto Rico he experienced firsthand the devastation of Hurricane Hugo. He pointed out that Puerto Rico was already facing numerous problems; the territory is poorer than any U.S. state with an average of $20k per house hold, goods cost 30 percent more than they do in the U.S. due to the Jones Act, and average electricity prices are 4 times as high as Florida due to antiquated electricity regulations, which is the highest in the Caribbean. He said that, “It’s almost as if we are deliberately strangling Puerto Rico.” He pointed out that Puerto Rico is already the site of the largest non-violence driven mass migration in the world, with over 500,000 people leaving in the last decade. The lack of effective action after this disaster could drive much of the rest of the population to migrate and seek refuge in the continental U.S. He recommended that the U.S. provide every source of relief at its disposal and to turn this crisis into an opportunity to showcase how to rebuild in a resilient manner after such a massive disaster.